Upgrade to a robust vault before the peak season!

Let’s be real. You wouldn’t leave your till open, so why risk your hard-earned cash in anything less than the real deal?

Cash Connect Vaults aren’t just tough - they’re South African tough. Built to SABS Category 4 standards, our world-class automated vaults are designed to make even the smartest criminals think twice, keeping your cash exactly where it belongs – safely in your retail store.

From the moment your cash is dropped in the vault, we assume the risk, giving you complete peace of mind. And that’s not all. With same-day settlements, affordable Cash-in-Transit (CIT) and cash deposit fees (CDF), as well as free supplier payments, you get a complete cash management solution that goes beyond safe.

Don’t store your cash like it’s 1999. Trade smarter. Protect your cash with the best in cash management solutions.

End-to-end retail cash management

With Cash Connect’s full end-to-end cash management there's an immediate risk transfer, and your cash is guaranteed from the moment the cash is deposited into the Cash Connect vault or EasyPay Cash ATM, whilst the cash is in transit (via the cash-in-transit (CIT) service) and until the cash is in the bank. Cash Connect guarantees the funds in your bank account instantly or same day°, enabling quick supplier payments, improved cash flow, and business continuity.

Stronger than the rest

Our robust automated cash vaults are built to SABS Cat 4 standards to withstand the toughest of attacks, and to deter criminal activity to softer and more vulnerable retail sites. Plus, our intelligent retail ATM Recycler is the only recycler in SA, built to SABS Cat 4 Standards, and is chemically bolted into the floor, making it highly resistant to attack. It also features banknote dye-staining protection, which deters criminals from targeting your store.

Our devices are central to the end-to-end cash management solution we provide to retail merchants. It's like having the bank in the store!

Save 40% of your time and money

- Lower cash processing fees.

- Eliminate staff touchpoints associated with manual reconciliations and banking to free up staff time for more meaningful work.

- Reduced shrinkage and increased accountability.

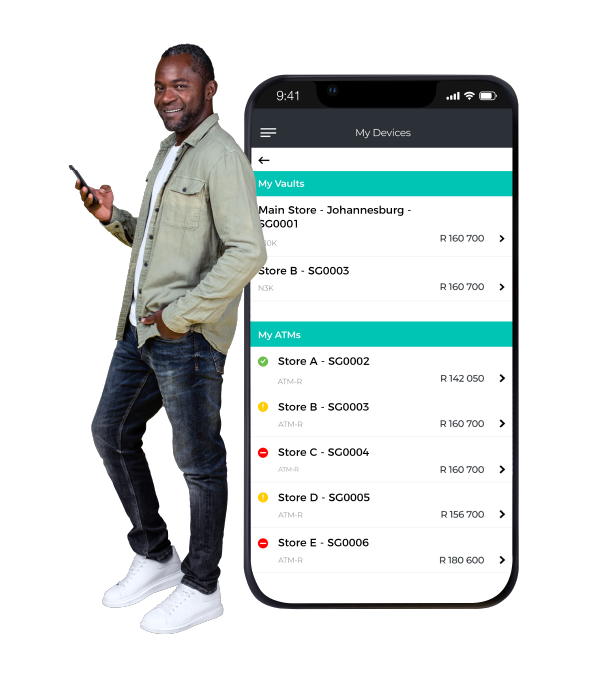

- Optimise your business efficiency and monitor your cash flow and CIT pickups via the Connected App.

- Improve your cash flow with same-day or real-time access to your cash whilst still in your vault or ATM Recycler, whenever you need it, with Instant Access°.

- Pay suppliers straight from the cash vault or ATM Recycler, no need to go into the bank or keep cash on-site for COD.

Real-time settlements

We understand that cash flow is the lifeblood that powers your business. That is why we offer next-day, same-day settlements and real-time settlements! With our Instant Access° facility, you can have access to your cash whilst the money is still safe and secure in the cash vault or ATM Recycler, whenever you need it! So, whether you need access to your cash for urgent supplier payments or for urgent repairs, you can access your funds at the click of a button using the Connected App.

The Cash Connect Offering

Stronger than the rest

Save time & money

We take the risk

Real-time settlements

Cash-and-dash biometrics

End-to-end cash management

You’re in safe hands!

Our end-to-end cash management solution is trusted by retail merchants across the country and we process in excess of R120 billion°° a year on behalf of our retail clients, making Cash Connect the leading cash processor in South Africa’s retail industry. We’re an approved cash service provider to many blue-chip companies including Spar, Shell, Engen, Pick ‘n Pay and OK, since 2006.

Retail Fintech

Cash Management

Provider of the year

Automated cash handling solutions have become an essential component of a successful retail store, which is why we’ve coupled our robust cash vaults and intelligent ATM Recycler with other fintech solutions designed to connect you as the retailer with opportunities for growth, one of the reasons we were named as the #1 Retail Fintech Cash Management Provider**.

Pay your business loan straight from your cash device!

You could also qualify for unsecured, unrestricted opportunity capital of up to R5 million in just 24 hours° from Capital Connect, and repay the business loan in daily instalments straight from the cash in your Cash Connect vault, smart ATM Recycler or bank account, so that you don’t feel the impact on your cash flow.

Pay your business

loan straight from

your cash device!

You could also qualify for unsecured, unrestricted opportunity capital of up to R5 million in just 24 hours° from Capital Connect, and repay the business loan in daily instalments straight from the cash in your Cash Connect vault, smart ATM Recycler or bank account, so that you don’t feel the impact on your cash flow.

Here’s what our Cash Connect

clients have to say

Cash Vault Range

- Up to 1500 notes

- Under-counter device

- 1 bag

- Single note feeder

- Up to 60 notes per/minute

- Built to SABS Category 4 standards

- Up to 3000 notes

- Under-counter device

- 1 bag

- Single note feeder

- Up to 60 notes per/minute

- Built to SABS Category 4 standards

- Up to 10,000 notes

- 1 bag

- High speed validator

- Up to 300 notes/minute

- Sliding door feature which removes the traditional swing door and optimises valuable retail space

- Built to SABS Category 4 standards

Ideal for retailers that deal with large volumes of notes and coins such as distribution centers, depots, cash & carries, etc.

- Up to 10,000 notes

- Bank notes and Coins

- High speed validator

- Up to 800 notes/minute

- Built to SABS Category 4 standards

EasyPay Cash ATM Range

The EasyPay Cash ATM, from Cash Connect, is a 3-in-1 drop safe, dispenser and recycler all-in-one, designed specifically to accept bulk cashier deposits quickly, whilst at the same time allows in-store shoppers to do cash withdrawals.

- Capacity of 15 000 banknotes

- Recycling up to 4 denominations in 4 cassettes

- Up to 600 banknotes per minute 4-way acceptance, mixed denominations 300 notes per individual transaction (deposit and withdrawal)1 bag

- High speed validator

- Built to SABS Category 4 standards

What is a cash vault?

A cash vault is an automated and intelligent business safe used to protect the cash on a business premises and for effective cash management processes, particularly in retail environments where cash volumes are significantly high. A robust cash vault is crucial for retail businesses in South Africa where cash is high on the criminal agenda.

What are the benefits of using Cash Connect vaults?

Cash Connect develops robust, automated cash vaults built to SABS Cat 4 standards, which enables retailers to trade in a safe and secure environment and effectively manage their cash onsite.

In South Africa retailer businesses have a 1 in 4 chance of being a victim to retail cash crime. Cash Connect offers its retail clients with a range of robust cash vaults which acts as an effective crime deterrent, and ultimately providing a retail cash solution that is Beyond Safe.

Cash Connect offers an end-to-end cash management and payment solution which reduces the cash risk with an inclusive cash-in-transit (CIT) service as part of the client’s holistic cash handling solution. The cash solution from Cash Connect allows retailers to safely pay suppliers instantly ,whilst the cash is still in the vault.

Cash Connect clients enjoy the benefit of unsecured business finance with Cash Connect Capital, enhancing business efficiency and improving cash flow with a cash injection that is fast, flexible and hassle-free. This offering allows Cash Connect to take retailers from a place of safety, to a place of growth.

What is the difference between a retail cash vault and a drop safe?

Cash Connect clients enjoy the benefit of unsecured business finance with Cash Connect Capital, enhancing business efficiency and improving cash flow with a cash injection that is fast, flexible and hassle-free. This offering allows Cash Connect to take retailers from a place of safety, to a place of growth.

**2022 Africa Excellence Awards (AI Global Media Ltd)

***Most Effective Contact Centre 2025 I Contact Centre Management Group

°Same day settlement processes to be followed to guarantee same day settlement | connected.co.za/instantaccess

*connected.co.za/capitalterms

°°Figures according to FY2023

Cash Connect Payment Holiday T&Cs