Click & Borrow R5 million growth capital in 24 hrs

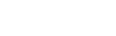

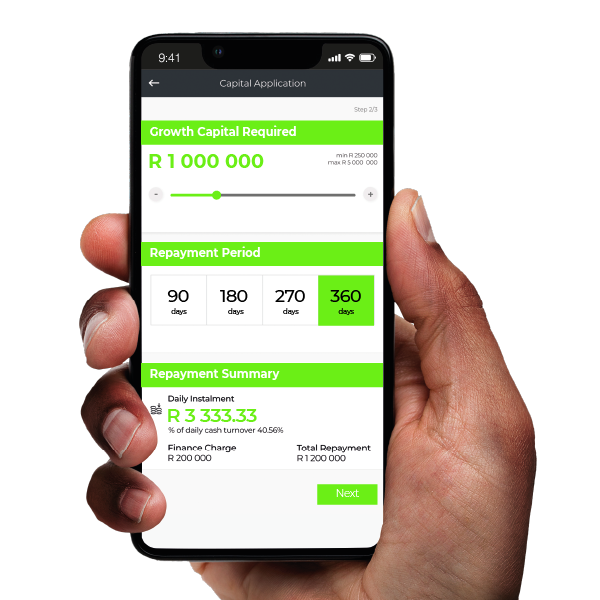

We understand that cash flow is the lifeblood of a retail business. Imagine what R1 million in your bank account can do for your retail growth – stock up, install perishable fridge doors, renovate your store, add a profit centre to your existing site, invest in energy-saving solutions, or make bulk purchases at discounted rates - the possibilities are endless!

That is why we’ve designed an unsecured business funding solution guaranteed to connect you to hassle-free working capital of up to R5 million in just 24hrs.

Funding without

the fuss!

You could qualify for unsecured, short-term capital of up to 50% of your average monthly turnover. No red tape. No audited financials are required. The loan can be repaid in affordable small daily instalments, straight from the cash in your Cash Connect cash vault, ATM Recycler or debits from your bank account - so it doesn't impact your operating cash flow.

This is what the future looks like - alternative business finance that’s fast, flexible and without the fuss.

Spotted an opportunity and need quick access to business funding?

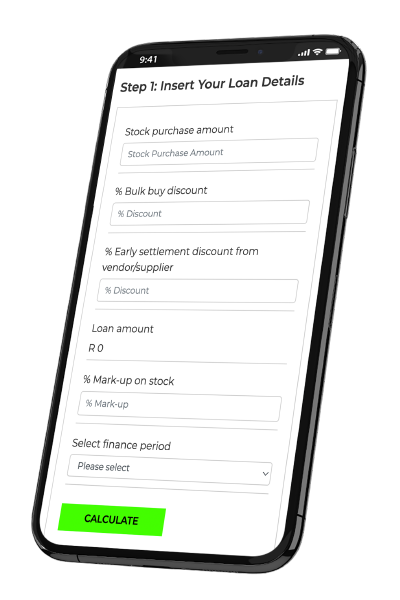

Opportunity capital empowers savvy retail entrepreneurs to outsmart their competitors. Unlock your competitive advantage and maximise your bottom line - use our Opportunity Capital Calculators to see the cost of finance and how much profit you can make with each opportunity.

So, go on, click ‘Calculate now’ below, and let our Stock- and Fuel Calculators crunch the numbers for you!

The offering

24 Hours

Flexible

Unsecured funding

No asset cover or audited financials required

Daily instalments

Affordable, daily instalments from your Cash Connect device or your bank account

Trusted

70% of clients return to make use of our capital again

Consult with a Capital Growth Specialist

Consult with a Capital Growth Specialist

Choose an award-winning fintech funder

Offering innovative business finance solutions is one of the many reasons Capital Connect was awarded the Retail Business Funder of the Year 2021, the Best Retail Fintech Funder 2024 (South Africa) in the Wealth & Finance FinTech Awards, as well as the Most Innovative Retail Finance Provider South Africa in the Global Brand Awards 2024. Capital Connect offers much-needed alternative business finance to South African retail merchants, to capitalise on opportunities and grow their businesses. Retailers can get hassle-free capital up to R5 million in 24 hours, with no need for audited financials.

Here’s how some of our Capital Connect

clients have used their capital

How do I apply?

At Capital Connect we made applying for business funding easy for retailers! Simply download the Connected App (iOS I Android), register and complete the Capital application form. Alternatively, call us on 0861 FUNDED and speak to one of our Capital consultants.

How much do I qualify for?

The minimum retail finance that you may apply for is R50,000. You may qualify for business funding in an amount equal to 50% of your average monthly turnover (cash and card payment receipts). Depending on your average monthly turnover, you may qualify for up to R5m or more!

How long do you have to repay?

We offer you a choice of 90 days, 180 days, 270 days or 360 days.

How long will it take to receive the funding in my bank account?

Funds will reflect in your bank account within 1 hour of Capital Connect receiving the signed loan agreement, where all conditions of the loan agreement have been met. T&Cs

Do I need to provide security?

At Capital Connect we provide retailers with unsecured business funding (business loan). You are not required to provide security to us for repayment of the loan in the form of assets. We do however require that we receive a written personal payment guarantee.

Is my credit rating important?

Yes, your credit rating is important. Seeing that we offer unsecured lending, we are not able to provide retail finance if you have a material judgement against your name.